Key Topics

- Pay for BUS 550 financial management course Offered by Westcliff University at AllAssignmentHelp.com

- BUS 550 Westcliff University Course Description

- Course Learning Outcomes (CLOs) Linked to Program Outcomes

- BUS 550 Financial Management - CLA Linking Table

- BUS 550 Westcliff University Course Outline in Detail

- Get Appropriate Help With BUS 550 Financial Management Online Course At Our Portal

Pay for BUS 550 financial management course Offered by Westcliff University at AllAssignmentHelp.com

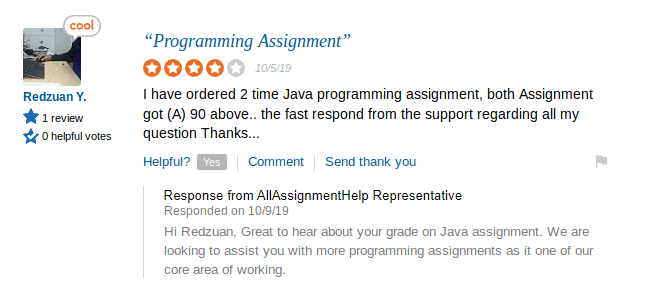

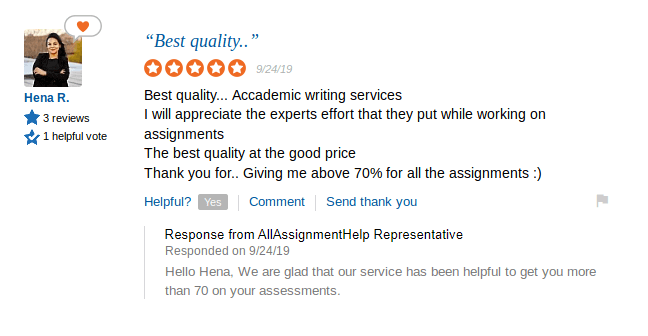

BUS 550 financial management is a course offered by Westcliff University (college of business) and is a completely online course. This course comes under a master in business administration program that focuses on the principles of financial and managerial accounting. AllAssignmentHelp.com is a website that offers complete online course help to students who have enrolled themselves in any online course. We cover all the assignments tasks, online classes, exams, and quizzes under our service. Therefore, if you are looking to pay someone to take your online class or exam for the BUS 550 Westcliff University course, you can buy help from us or hire our experts to assist you throughout.

In the meantime, you can have a look at the course prerequisites, curriculum, and other relevant information to keep yourself regarding the course.

BUS 550 Westcliff University Course Description

This is an 8 weeks program that consists of 3 units. This is a financial and managerial accounting course with a focus on application. The course focuses on financial and managerial accounting principles that are utilized to make complex strategic and operational decisions.

The goal of this course is to educate decision-makers with the financial and managerial accounting theory, concepts, and tools they need to make better financial management decisions, as well as to enable students to make informed judgments about financial analyses done by others.

Details of Required Texts For BUS 550

Ross, S. A., Westerfield, R. W., & Jordan, R. D. (2019).

Fundamentals of corporate finance (12th ed.). McGraw-Hill

Print ISBN: 978-1259918957

eText ISBN: 978-1260153651

Method of Instructions

In both a classroom setting and an online learning system, students communicate with one another and with professors. Lecture discussions, presentations, cooperative learning, and case studies will be used to aid learning. However, you can take online assignment help from us with any type of task.

BUS 550 financial management Course Scope

Professional individual assignments, discussion postings, thorough learning tests, and class participation are used to assess student outcomes.

Course Learning Outcomes (CLOs) Linked to Program Outcomes

Learning outcomes define what a student will know and be able to do at the end of a course - the essential and enduring knowledge, abilities (skills), and attitudes (values, dispositions) that make up the integrated learning required of a course graduate.

The learning outcomes for this course explain what students should expect to learn and how this course relates to the MBA degree's educational goals.

| Course Learning Objectives (CLOs) | MBA Program Objectives |

(K) Knowledge (S) Skill (A) Attitude |

| 1. Recall accounting and finance vocabulary, terminology, charts, tables, equations, and calculations. | 1, 2, 3, 9 | K, S |

| 2. Analyze and evaluate a Balance Sheet, Income Statement, and Statement of Cash Flows. | 1, 2, 3, 6, 9 | K, S |

| 3. Calculate and evaluate Present Value, Future Value, Net Present Value, Internal Rate of Return (IRR), Profitability Index (PI), and Coefficient of Variance (CV) as applied in capital investment projects. | 1, 2, 3, 6, 9 | K, S |

| 4. Evaluate short-term versus long-term investment decisions, increasing shareholder values. | 2, 6, 8 | K, S |

| 5. Compile technical and strategic investment principles. | 1, 2, 6 | K, S, A |

| 6. Determine and evaluate the performance of a well-diversified portfolio. | 4, 6, 7, 9 | K, S |

| 7. Distinguish and apply the principles of T-accounts, debits, and credits. | 1, 2, 4, 6, 9 | K, S |

BUS 550 Financial Management - CLA Linking Table

Course Learning Outcomes are measured directly by Comprehensive Learning Assessments (CLAs), Professional Assignments (PAs), and Discussion Questions (DQs), whereas MBA Program Outcomes are measured indirectly by CLAs, PAs, and DQs.

The table below illustrates how they are all connected.

| Comprehensive Learning Assessments (CLAs) | Course Learning Outcomes (CLOs) | MBA Program Outcomes |

| CLA 1 (Week 4) | 1, 2, 3, 4, 5, 7 | 1, 2, 3, 4, 6, 8, 9 |

| CLA 2 (Week 8) | 1, 2, 3, 4, 5, 6, 7 | 1, 2, 3, 4, 6, 7, 8, 9 |

PA Linking Table

| Professional Assignments (PAs) | Course Learning Outcomes (CLOs) | MBA Program Outcomes |

| PA 1 (Week 2) | 1, 2, 5 | 1, 2, 3, 6, 9 |

| PA 2 (Week 6) | 1, 2, 3, 4, 5, 6, 7 | 1, 2, 3, 4, 6, 7, 8, 9 |

DQ Linking Table

| Discussion Questions (DQs) | Course Learning Outcomes (CLOs) | MBA Program Outcomes |

| DQ 1 (Week 2) | 1, 2, 5 | 1, 2, 3, 6, 9 |

| DQ 1 (Week 6) | 1, 2, 3, 4, 5 | 1, 2, 3, 6, 8, 9 |

| DQ 1 (Week 7) | 1, 2, 3, 4, 5, 6, 7 | 1, 2, 3, 4, 6, 7, 8, 9 |

Activity Linking Table

| Activity | Course Learning Outcomes (CLOs) | MBA Program Outcomes |

| Activity 1 (Week 1) | 1, 2, 5 | 1, 2, 3, 6, 9 |

| Activity 2 (Week 3) | 1, 2, 3, 4, 5, 7 | 1, 2, 3, 4, 6, 8, 9 |

| Activity 3 (Week 5) | 1, 3, 4, 5, 6 | 1, 2, 3, 4, 6, 7, 8, 9 |

BUS 550 Westcliff University Course Outline in Detail

Week by week, the following outline gives crucial assignment instructions for this course. You are entirely responsible for all of the tasks assigned to you. However, if you are unable to complete your assignment tasks, you can ask us to do my assignment for me online. We have experts who can write all your assignments for you that too with perfection.

-

Week 1

Assignments to complete this week:

- Reading: Fundamentals of Corporate Finance

Chapter 1: Introduction to Corporate Finance

Chapter 2: Financial Statements, Taxes, and Cash Flows

- Submit Activity 1 by Sunday at 11:59 p.m.

Activity 1 – CLO 1, CLO 2, CLO 5

ABC Company had $395,00 in additional retained earnings for the fiscal year that just concluded. The company paid a cash dividend of $195,000 and ended with $5.3 million in total equity. There are now 170,000 shares of ordinary stock outstanding in the corporation. Please respond to the following questions:

- What is E/PS (earnings per share)?

- What are the dividends per share?

- What is the share's book value?

- What is the market-to-book ratio of a stock that now sells for $64 per share?

- What is the price-to-earnings (P/E) ratio?

- With $5.15 million in sales, what is the price-to-sales ratio (P/S)?

Provide your explanations and definitions in detail and be precise. Provide your work in detail and explain in your own words.

-

Week 2

Assignments to complete this week:

- Reading: Fundamentals of Corporate Finance

Chapter 2: Financial Statements, Taxes, and Cash Flows

Chapter 3: Working with Financial Statements

- Post DQ Direct Response by Thursday at 11:59 p.m.

- Post DQ Peer Response(s) by Sunday at 11:59 p.m.

- Submit Professional Assignment 1 by Sunday at 11:59 p.m.

Discussion Question Information: Answer all questions thoroughly and be sure to provide one (1) direct response to the discussion question prompt and one (1) peer response.

Discussion Question 1 – CLO 1, CLO 2, CLO 5

Please respond to the following scenario/questions in a 200-250 word response:

Examine the fictional company Balance Sheet in Chapter 2: Table 2.1 of the textbook and the fictitious company Income Statement in Chapter 2: Table 2.2 of the textbook.

- What do you think each of these items means in terms of financial management?

- Why did you respond in this manner?

Professional Assignment 1 – CLO 1, CLO 2, CLO 5

Find the most current income statement and balance sheet of a significant firm using Yahoo Finance and/or any other trustworthy source(s), then supply the following information:

1. Type these statements in the correct format (financial statement)

2. Conduct a vertical financial analysis that includes the following factors

- Debt ratio

- Debt to equity ratio

- Return on assets

- Return on equity

- Current ratio

- Quick ratio

- Inventory turnover

- Days in inventory

- Accounts receivable turnover

- Accounts receivable cycle in days

- Accounts payable turnover

- Accounts payable cycle in days

- Earnings per share (EPS)

- Price to earnings ratio (P/E)

- Cash conversion cycle (CCC), and

- Working capital

- Explain Dupont's identity. Apply it to your selected company. Interpret the components in Dupont identity.

Be specific and detailed in your explanations and definitions. Make a comment on your findings. When necessary, include content references. Detail your work and describe it in your own words.

-

Week 3

Assignments to complete this week:

- Reading: Fundamentals of Corporate Finance

Chapter 4: Long-Term Financial Planning and Growth

Chapter 5: Introduction to Valuation, the Time Value of the Money

Chapter 6: Discounted Cash Flow Valuation

- Submit Activity 2 by Sunday at 11:59 p.m.

Activity 2 – CLO 1, CLO 2, CLO 3, CLO 4, CLO 5, CLO 7

Assume you think you'd need $50,000 per year to supplement your social security and maintain your preferred lifestyle if you retired right now. However, given annual inflation is on average 3%, retiring 30 years from now will require more than $50,000 per year to sustain the lifestyle you desire.

- When adjusted for inflation, how much will $50,000 be worth at retirement?

- What is the face value of the bond that yields the equivalent of $50,000 in coupon payment, as shown in #4 of Part B?

- How much annual contribution to a retirement account is required to build the funds required to buy the bond when you retire?

- What is the purchasing power of the sum that your heirs will receive measured in the current value of the dollar at the time the retirement account was opened?

(Hint: First figure out what the future value will be in 30 years, which is $50,000 right now, and then solve the rest of the issue.)

-

Week 4

Assignments to complete this week:

Reading: Fundamentals of Corporate Finance

Chapter 6: Discounted Cash Flow Valuation

Chapter 9: Net Present Value and Other Investment Criteria

Chapter 10: Making Capital Investment Decisions

Chapter 11: Project Analysis and Evaluation

- Submit CLA 1 by Sunday at 11:59 p.m.

CLA 1 Comprehensive Learning Assessment – CLO 1, CLO 2, CLO 3, CLO 4, CLO 5, CLO 7

Please note that this CLA 1 assignment is divided into two sections. The first component, which is unrelated to the second, shows the cash flows for two mutually exclusive projects. A capital budgeting scenario is presented in the second part.

-

Week 5

Assignments to complete this week:

- Reading: Fundamentals of Corporate Finance

Chapter 6: Discounted Cash Flow Valuation

Chapter 7: Interest Rates and Bond Valuation

Chapter 8: Stock Valuation

Chapter 9: Net Present Value and Other Investment Criteria

Chapter 10: Making Capital Investment Decisions

Chapter 11: Project Analysis and Evaluation

- Submit Activity 3 by Sunday at 11:59 p.m.

Activity 3 - CLO 1, CLO 3, CLO 4, CLO 5, CLO 6

Please complete both portions of this activity.

Part - 1

A and B are two bonds that have the same credit rating, par value, and coupon rate. Bond A will mature in 30 years, while Bond B will mature in 5 years. Please answer the following questions to demonstrate your grasp of interest rate risk:

- Discuss which bond in the market will trade at a greater price.

- Discuss what happens to each bond's market price if interest rates in the economy rise.

- If interest rates rise, which bond will see a greater percentage price change?

- Please provide numerical evidence to back up your claim.

- As a bond investor, how would you invest if you anticipate a slowdown in the economy during the following 12 months?

Part - 2

To grasp the fundamentals of portfolio theory, you must be familiar with random variables. Given that the CLA 2 assignment is about portfolio construction, you'll want to brush up on your random variable handling skills. Please review and explain the importance of basic random variable concepts such as the mean, variance, standard deviation, and correlation.

We can provide you complete financial management assignment help service so that you can complete all your assignments with perfection. Also, our experts will guide you with everything as well related to the BUS 550 financial management course.

-

Week 6

Assignments to complete this week:

- Reading: Fundamentals of Corporate Finance

Chapter 8: Stock Valuation

Chapter 12: Some Lessons from Capital Market History

Chapter 13: Return, Risk, and the Security Market Line

Chapter 14: Cost of Capital

- Post DQ Direct Response by Thursday at 11:59 p.m.

- Post DQ Peer Response(s) by Sunday at 11:59 p.m.

- Submit Professional Assignment 2 by Sunday at 11:59 p.m.

Discussion Question 1 – CLO 1, CLO 2, CLO 3, CLO 4, CLO 5

Please respond to the following questions in a 200-250 word response, and back your position with peer-reviewed evidence:

On this basis, compare and contrast the risk versus an expected rate of return tradeoff, the security market line, and beta determination.

- Include a description of each component, including the security market line, risk measure, the estimated rate of return, risk-free rate of return, and market rate of return.

- For greater clarity, use hypothetical instances.

What is the meaning of the weighted average cost of capital (WACC)?

- For more clarity, can you think of two hypothetical examples?

Professional Assignment 2 – CLO 1, CLO 2, CLO 3, CLO 4, CLO 5, CLO 6, CLO 7

Part 1 of the PA 2 focuses on analyzing beta and WACC, while Part 2 focuses on data collection in preparation for the CLA 2. To demonstrate your detailed appraisal of the company's opportunity cost as well as your skills in acquiring and organizing historical data on securities for the goal of portfolio creation, you must complete both components in your 3-5-page, APA-formatted report.

-

Week 7

Assignments to complete this week:

Reading: Fundamentals of Corporate Finance

Chapter 11: Project Analysis and Evaluation

Chapter 13: Return, Risk, and the Security Market Line

Chapter 14: Cost of Capital

- Post DQ Direct Response by Thursday at 11:59 p.m.

- Post DQ Peer Response(s) by Sunday at 11:59 p.m.

- Complete quiz by Sunday at 11:59 p.m.

Discussion Question 1 – CLO 1, CLO 2, CLO 3, CLO 4, CLO 5, CLO 6, CLO 7

The ABC Company has engaged you to explain how to evaluate a security's performance using the expected rate of return, the standard deviation of the rate of return, and coefficient of variation (CV).

They also want you to show how, by putting together a portfolio, you can create an instrument with better qualities than each of its elements in terms of the standard deviation of the rate of return and CV.

In a 200-250-word response, how would you explain and present this information to ABC Company, backed up by relevant academic and peer-reviewed data?

Quiz - Online

The quiz can be found on your course GAP site under Week 7. The quiz will begin on Monday and end at 11:59 p.m. on Sunday. You will only be given one (1) chance to complete the quiz. Please consult the University Policies for Grading Criteria for Exams and Quizzes.

-

Week 8

Assignments to complete this week:

- Reading: Fundamentals of Corporate Finance

Review all chapters covered that will assist in the completion of the CLA 2 assignment

- Present CLA 2 Presentation during the last class meeting

- Submit CLA 2 by Sunday at 11:59 p.m.

CLA 2 Comprehensive Learning Assessment 2 – CLO 1, CLO 3, CLO 4, CLO 5, CLO 6, CLO 7

This is a Word document that contains a detailed written report on the formation of your portfolio. Your historical data and applicable derived values in tables can be pasted into the Excel file from prior calculations. Please provide explanations and reasons for all calculations in Word format. Also, ensure that all underlying Excel formulae used for computations are pasted into the Word document.

- Provide the information you provided in Part 2 of Professional Assignment 2 once more.

- Calculate the yearly rate of return of each security's mean, variance, and standard deviation.

- Determine the correlation coefficient between the yearly rates of return of every conceivable pair of securities.

- Decide how much of your first investment you wish to put into each of the five (5) securities (weights in the portfolio).

- Find the combination of the weights that minimize the CV of the portfolio.

- Assume that you initially invested $1,000,000 in the portfolio and that the distribution of the annual rate of return of the portfolio is normal.

Is buying online course help costing you high?

Take help from us and pass the course with flying colors just at an affordable price

Place your orderGet Appropriate Help With BUS 550 Financial Management Online Course At Our Portal

BUS 550 Financial Management course holds a lot of theoretical and practical concepts. For students, it might get difficult to ace all the concepts easily. On top of that, attending online classes and exams can become too hectic as well. Thus, to help students and to make them less stressed with the course class, exams, and assignments, our experts are here to guide them. This means you will get your online course certification completed under an expert's guidance. Also, if you want someone to assist you with the MTH 1207 – V03 Fundamental Concepts of Mathematics course online, then you can contact us as well. We are always here to assist you in the best possible manner.

+1-817-968-5551

+1-817-968-5551 +61-488-839-671

+61-488-839-671 +44-7480-542904

+44-7480-542904