Table of Contents

According to a survey, the demand for investment banking professionals in the U.S. is projected to grow steadily, with firms actively seeking skilled candidates who can handle complex financial markets. The investment banking industry is fiercely competitive and demanding in the USA. Furthermore, the U.S. is home to some of the best investment banking programs, offering in-depth knowledge of financial modeling, valuation, mergers and acquisitions, and capital markets. One can enroll in investment banking courses in the USA of their choice to boost their finance career. However, the question is, which course to choose? Don’t worry! In this blog of All Assignment Help, we have curated a list of the 7 Top Finance Courses for Investment Banking that can help you gain a competitive edge in this high-stakes industry.

What is Investment Banking?

Investment Banking is an advisory-based branch of banking that deals with significant financial transactions, usually involving governments, businesses, organizations, and investment funds.

These banks help with mergers and acquisitions (M&As) and raise capital by offering underwriting services. In simple terms, investment banking supports large, intricate financial transactions by acting as a financial intermediary.

Investment banking is a specialized area within finance. Hence, students who enrolled in the best investment banking courses in the USA should know the basics of finance as well. Those who aren’t familiar with its basics can choose to hire a finance assignment help expert who will assist them in understanding the finance basics and how to apply them in investment banking.

Read Here: Concept of E-Banking -Information Technology

7 Best Investment Banking Courses in the USA

The industry of investment banking is extremely competitive, and there are several esteemed universities and institutes in the USA that have a track record of bringing out great alumni. These institutions provide complete education, specialized investment banking certification programs, and access to eminent academics and professionals in the field.

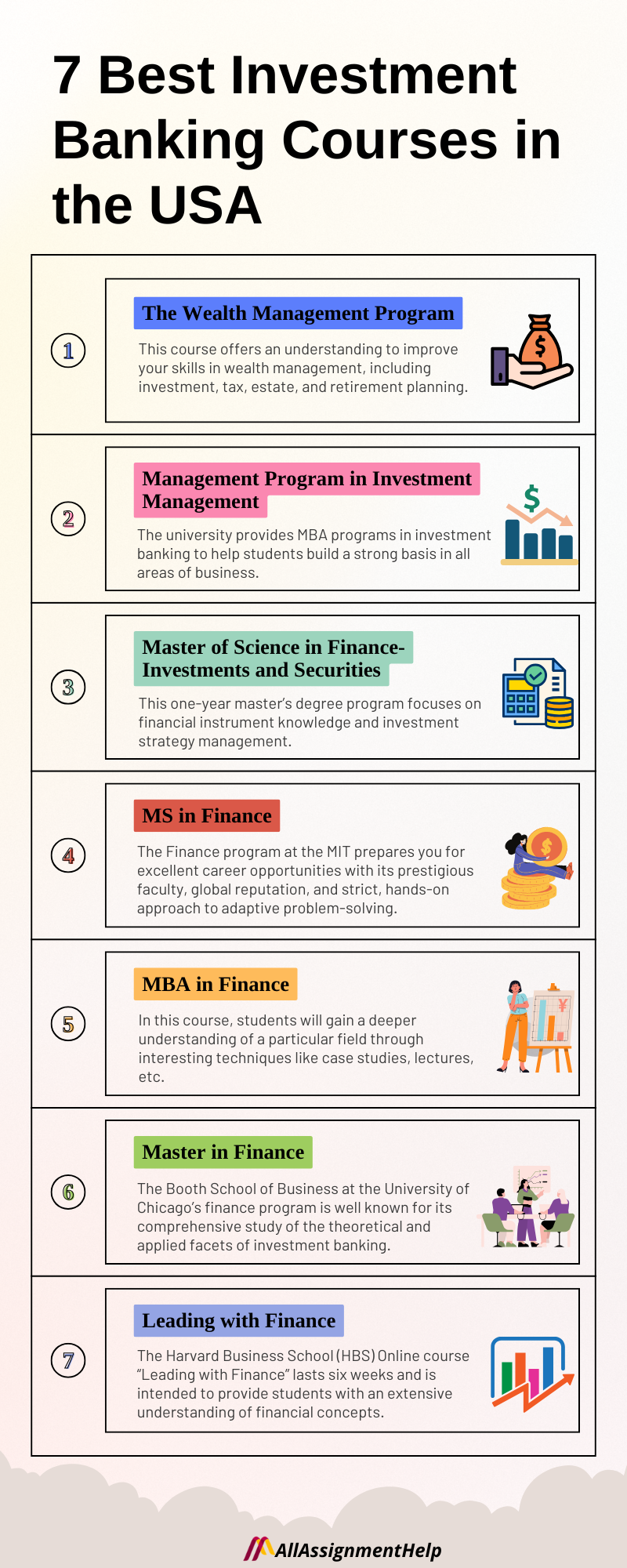

Let’s explore the 7 top finance courses for investment banking offered in the USA:

The Wealth Management Program

Offered by: Columbia University

Duration: Two years

Fee structure: 26,609.68 USD per year

This course offers an understanding to improve your skills in wealth management, including investment, tax, estate, and retirement planning. The curriculum is centered on problem-based learning to promote cooperation, teamwork, and critical thinking.

This course offers five optional areas in addition to three core modules to help students improve their marketing skills.

- Module 1-Investment Strategies

- Module 2- Asset Allocation and Portfolio Management

- Module 3-Trusted Client Advisory

The elective topics are as follows:

- Corporate Governance

- ESG Investing

- Mergers and Acquisitions

- Real Estate Investing Strategies

- Value Investing

This course is also available online, allowing you to earn a degree from the comfort of your home. However, online learning comes with challenges, often leading students to seek external support. Fortunately, online class helpers specialize in taking classes on behalf of students and make their coursework easier to manage. Finding a reliable service where you can pay someone to take your online class can help you overcome these challenges and stay on track with your studies.

Management Program in Investment Management

Offered by: Pace University

Duration: One year

Fee structure: 41,684.25 USD per year

Pace University is the second-ranked institution that provides Investment Banking Courses in the USA. The university provides MBA programs in investment banking to help students build a strong basis in all areas of business and tackle challenging financial problems.

Course key modules include:

- Business Economics for Decision-making

- Financial Accounting for Managers

- Driving Marketing Performance

- Creating Value Through Finance

- Business Analytics and Statistics

- Managing Operations and Projects

- Leading and Managing Teams

- Global Business, Ethics, and Social Responsibility

Concentration Electives (Select three courses from the list below)

- Portfolio Analysis and Management

- Strategies in Investments, Options and Futures

- Fixed Income Markets and Analytics

- Risk Management and Capital Market

- Behavioural Finance

- Real Estate Finance

Capstone Project

- Strategic Decisions

There are three sections to this course: the basic topics, six optional topics (of which students must select three), and the capstone.

Master of Science in Finance- Investments and Securities

Offered by: Southern New Hampshire University

Duration: One year

Fee structure: 21,564.21 USD

Southern New Hampshire University is ranked among the best for Master’s Degree Programs that also cover Online Investment Banking Courses in the USA. This one-year master’s degree program focuses on financial instrument knowledge and investment strategy management.

Course module includes:

- Managerial Economics

- Fiscal and Monetary Policies and Practices

- Financial Management

- Analytical Tools in Portfolio Management

- Options Analysis

- Financial Derivatives

- International Investment

- Portfolio Management

- Money and Capital Markets

- Capital Budgeting and Financing

- Financial Econometrics

- Seminar in Finance

- Quantitative Analysis for Decision-Making

Their method of instruction is grounded in practical financial analysis, decision-making, and technical and quantitative skills. All of the teachers are finance experts, and they use the most effective teaching strategies.

MS in Finance

Offered by: Massachusetts Institute of Technology

Duration: Two years

Fee structure: 874,559.37 USD per year

This institution should be considered for providing one of the Best Investment Banking Courses in the USA. The Finance program at the Massachusetts Institute of Technology (MIT) prepares you for excellent career opportunities with its prestigious faculty, global reputation, and strict, hands-on approach to adaptive problem-solving.

Course module includes:

- Modern Finance

- Corporate Financial Accounting

- Financial Markets

- Corporate Finance

- Analytics of Finance

- Proseminar in Capital Markets

- Investment Management

The institution prepares students to take on challenging technical problems by creating a demanding academic atmosphere. Also, MIT promotes multidisciplinary cooperation while doing ground-breaking research.

MBA in Finance

Offered by: Stanford University

Duration: Two years

Fee structure: 1,010,763.81 USD per year

Stanford University holds the 5th position in offering the best investment banking courses in the USA. In this course, students will gain a deeper understanding of a particular field through interesting techniques like case studies, lectures, seminars, simulations, prototyping, role-playing, hands-on activities, project-based learning, and cooperative teamwork.

Course module includes:

- Institutional Money Management

- Corporate Financial Modelling

- Financial Trading Strategies

- Private Equity Investing Seminar

- Debt markets

- Investment management and Entrepreneurial Finance

- International Finance and Macroeconomics

- Entrepreneurial Finance

- China’s Financial system

- Financial Restructuring

- Private Wealth Management

- Personal Investing

This course gives students a special chance to broaden their horizons and acquire worthwhile experience. However, those who find it difficult to meet the course requirements set by the university can also buy Stanford University assignment help services from experts. This will help them stay on track while meeting every single requirement of the course and the university.

Master in Finance

Offered by: University of Chicago

Duration: 15 months

Fee structure: 28,750 USD per quarter

The Booth School of Business at the University of Chicago’s finance program is well known for its comprehensive study of the theoretical and applied facets of investment banking. It offers specialized courses in corporate finance, private equity, and investment banking.

Students must select 9 electives and 4 core courses from the available selections, for a total of 13 courses. There will be five electives in finance and four electives from different MBA courses.

Course module includes:

- Financial Accounting & Analysis

- Corporation Finance

- Financial Analytics

- Accounting and Financial Analysis

- Quantitative Portfolio Management

- Fixed Income Asset Pricing

- Advanced Investments

- Behavioral and Institutional Finance

- Financial Econometrics

- New Venture Strategy

- Building the New Venture

- Quantitative Portfolio Management

- Blockchain, Cryptocurrencies, and Web3

- Advanced Investments

Booth provides a Master of Finance Program, supported by leading finance academics for recent college graduates in quantitative subjects. This program offers extensive education and skill development for success in the diverse financial sector.

Leading with Finance

Offered by: Harvard University

Duration: 6 weeks long

Fee structure: 1,750 USD

The Harvard Business School (HBS) Online course “Leading with Finance” lasts six weeks and is intended to provide students with an extensive understanding of financial concepts. The curriculum seeks to provide students with the resources they need to make wise financial decisions and efficiently interact with stakeholders.

Course Module Include:

- Corporate finance

- Finance

- Investing

- Career Development

- Professional Development

- Self-Improvement

The course covers around 35 to 40 hours of content spread throughout six weeks. The coursework can be finished at any time, as long as students meet the scheduled due dates. Furthermore, students enrolled in this course also need to complete multiple assignments and writing tasks within a provided deadline. Those who find it difficult to write their assignment can get online assignment help and hire an expert to do the assignment before the deadline.

Also Read: Is MBA Degree Still a Smart Career Move After Seeing Future Trends?

Careers in Investment Banking

There are several professions in investment banking that contribute to the bank’s capacity to precisely, securely, and effectively raise money for governments and businesses. Jobs in investment banking include:

Investment Banking Analyst

This is an entry-level role that usually needs graduates with backgrounds in business, economics, or finance. It includes pitchbook preparation, market research, valuation, and financial modeling. Although it demands a lot of work, this career offers a strong foundation in finance.

Accountants

Accountants monitor and document the financial performance and commercial dealings of an organization. Those who choose to be an accountant after earning a degree or certification in investment banking need to have a firm understanding of accounting. However, there are a plethora of accounting assignment help services available online to help individuals who need additional assistance with any area of accounting.

Investment Bankers

Investment bankers help customers identify and arrange M&As, underwrite securities, and develop financial models to help them make financial choices. They also raise funds and offer financial guidance.

Actuaries

Actuaries forecast how different circumstances can impact a company’s finances and assess the risk associated with financial decisions.

Director / Senior VP

The main duty of the director or senior vice president is to attract new business. They oversee the implementation of deals and manage client relationships. Additionally, they collaborate closely with managing directors on significant deals.

Managing Director (MD)

This senior role is in charge of closing transactions and increasing income. For this role, having extensive industry knowledge and solid client contacts are essential. This additionally highlights long-term company expansion.

Money is the main reason why many individuals choose a profession in investment banking: even at the mid-level, you will rank in the top 1% of earners in the majority of nations and states.

Conclusion

There are several career choices in the highly dynamic field of investment banking. One can transition from a private company to a government ministry, such as the Department of Finance, at any time. Those who are efficient and possess strong technical and soft skills can find this field to be lucrative.

If you are pursuing investment banking courses in the USA and need additional assistance to ace your coursework, you can rely on our team of subject experts to assist you. We have experienced professionals in the investment banking area to assist students with their coursework by completing their assignments and other writing tasks. Moreover, they can take your online exam as well so that you can score the highest scores in your curriculum.

FAQs

Do investment bankers earn high salaries in the USA?

Yes, the competitive nature of the financial business and its compensation structure allow investment bankers in the US to earn substantial salaries and bonuses. The work involves interacting with corporate finance transactions, enabling mergers and acquisitions, underwriting securities, and offering financial advising services.

Which degree is ideal for a career in investment banking?

A degree in finance is the best option for someone who hasn’t begun school yet and wants to work in investment banking. One can develop the hard and soft skills required for success in the fast-paced investment banking industry by obtaining a bachelor’s degree in finance.

What are the best investment banking certification programs?

The CFA designation is one of the and demanding qualifications available to banking and finance professionals. The Chartered Financial Analyst Institute oversees the certification process.