Table of Contents

Today, the banking industry has evolved like never before all thanks to technology. This blog by All Assignment Help talks about the concept of E-banking. When we say E-banking, we are talking about the hypernym involving internet banking, mobile banking, NEFT, IMPS transfers, etc. Moreover, E-banking comes naturally to customers and helps them solve their banking issues or make any financial or non-financial transactions such as getting a mini statement, changing their ATM PIN, checking their balance, etc. Now, let us read more about the concept of E-banking.

Understanding E-Banking

Today’s banking industry cannot exist without E-banking, also referred to as online banking or internet banking. Through safe online channels, clients can handle their accounts and carry out a variety of financial operations. Moreover, E-banking systems have been developed and adopted with great effect from the spread of the Internet and technological innovations.

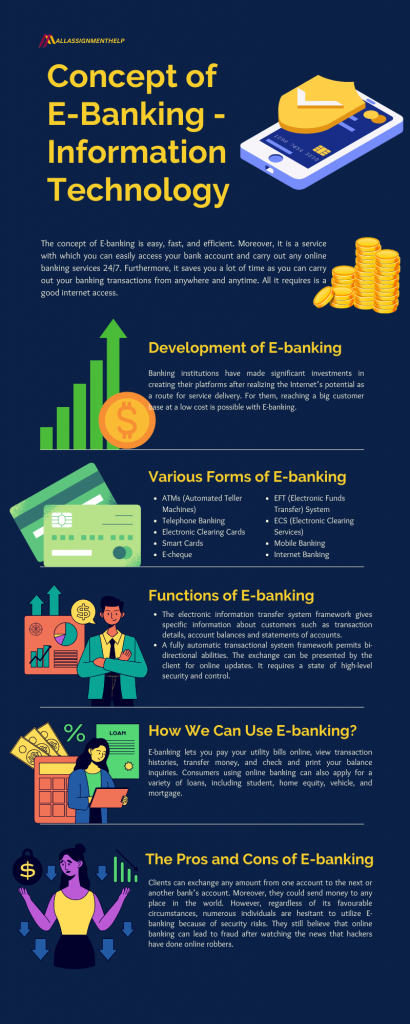

The concept of E-banking is easy, fast, and efficient. Moreover, it is a service with which you can easily access your bank account and carry out any online banking services 24/7. Furthermore, it saves you a lot of time as you can carry out your banking transactions from anywhere and anytime. All it requires is a good internet access. There’s still a lot to E-banking. Let’s read about it.

- Accurate summary of all the funds in your bank account.

- Current account statement including credits, overdrafts, and deposits made by you.

- Execution of transfers in different currencies, both domestically and internationally.

- Completing the payment of all utility bills, including those for telephone, water, and electricity.

- Processing payments for customs.

- All transactions completed using E-banking are confirmed electronically.

- Control over your credit cards.

Also read: Why Finance Is a Best Career Path in 2023

Development of E-banking

The advancement of E-banking has grown significantly in the last few years. Moreover, banking institutions have made significant investments in creating their own platforms after realizing the Internet’s potential as a route for service delivery. For them, reaching a big customer base at a low cost is possible with E-banking. Furthermore, banks save time and money by communicating with consumers and responding to their many inquiries and requests when they have the chance to cross-sell their goods and services to a larger group of people.

In addition to this, customers can handle their finances more effectively and feel in charge of them than ever before. Moreover, E-banking has made this world a good place to conduct business and get financial services. Now, people can pay their bills online, move money between accounts and check their account balances and transactions. Additionally, they may compare the goods and services provided by several banks with just a few clicks. Also, with advancements in technology, online banking will only get better. Thus, in the future, we probably will not see anything but increased advantages for banks and their clients.

Also read: How to Stay Motivated in Your Online Finance Class?

Various Forms of E-banking

Online and mobile banking, automated teller machines (ATMs), debit and credit cards, and online internet banking are the main modalities of e-banking. Even if you already know this, it’s important to understand each kind.

Internet banking

Online banking, sometimes referred to as net banking or internet banking, is an electronic platform run by banks that allows users to access both financial and non-financial services. Previously, even minor services required clients to visit the banks. But nearly every service and product is now available online thanks to the introduction of Internet banking. This banking method is safe in addition to being convenient. In order to access net banking, clients must first register with the bank for online banking.

- Registering for online banking is open to anyone with a current account or savings account at any bank.

- A personal computer, laptop, or mobile device, as well as a strong internet connection, are required for net banking to operate correctly.

- Once an individual registers, the bank provides a distinct client ID and password to use the online banking interface.

Automated Teller Machines (ATM)

ATMs, or automated teller machines, are a convenient and rapid means of conducting individual transactions. You do not need to visit the bank branch or need assistance from a real teller to do self-serviced transactions thanks to these devices. Moreover, money transfers, deposits, and withdrawals are just a few of the numerous operations that may be completed by automated teller machines, or ATMs. These additional activities give the ATMs a more effective service, even though cash withdrawals are the primary use for them.

An ATM just requires a credit or debit card, which you must swipe or enter into its card reader in order to complete an automated teller machine (ATM) transaction. Since they are so simple to use, automated teller machines (ATMs) have emerged as one of the most practical methods to access banking services without physically going to the bank.

Telebanking

Through the use of any touchscreen phone, you can access your bank accounts around the clock using telebanking, an automated telephone banking service. You may quickly access recent deposit and withdrawal activity, ATM transactions, and information about your current balance with telebanking. Moreover, you can bank over the phone in particular if you are in an area without a dependable internet connection or if you do not want to use their online or mobile banking services.

Following a brief introduction, you will be required to input the four-digit security code and the number of your bank account. Moreover, the system will ask you to choose a new security code after you enter the last four digits of your social security number as the initial one when you log in for the first time. After logging in, a straightforward set of choices will appear to help you navigate your phone banking experience. Its features include transferring money across accounts, accessing account balances, deposits, and withdrawals around the clock, obtaining interest and loan information

E-cheque

E-cheques are cheques that are issued and signed electronically. Moreover, they are practical and effortless. Instead of only being possible during branch operating hours, deposits can be made via electronic channels around the clock. Furthermore, it uses public key infrastructure technologies and private keys. They are impossible to fake, unbreakable, and non-transferable. Also, electronic chequebooks are available to all qualifying customers, and they can be used to issue electronic checks.

Functions of E-banking

Given below are some vital functions of e-banking for you. You will have an idea about the e-banking system.

Electronic information transfer system

The framework gives specific information about customers such as transaction details, account balances and statements of accounts. Moreover, the information is still basically in the ‘Read Only’ form. The personality and confirmation of the client are done through the secret phrase. Furthermore, the information is drawn from the bank’s application framework either in bunch mode or disconnected. The application system can’t be accessed directly through the internet.

Fully automatic transactional system

This framework permits bi-directional abilities. The exchange can be presented by the client for online updates. It requires a state of high-level security and control. The application system and web server are linked with a secure infrastructure. It incorporates networking, computerization, and security, between techniques comprising legal infrastructure and inter-bank payment gateways.

In addition to this, E-banking as a subject in your finance classes can be a little complex as it is a blanket term that has many other topics to cover. The complexity might stress you and leave you with thoughts like, can I ask someone to take my online class for me? If it happens to you, simply ask an expert to take your class on your behalf. The technology hasn’t only made banking easy but it has transformed education as well. The experts will take your class and help you understand the topic easily.

How We Can Use E-banking?

No doubt internet banking made our life so easy. We do not need to stand in queues for long hours, we do not need to go anywhere to pay the bills, and much more work we can accomplish while sitting at home. This is possible just because of E-banking. Our experts have prepared a list of uses of E-banking.

For the payment of bills

You can pay the bills for telephone, cell phones, electricity, cards, and insurance premiums since each bank has tie-ups with different service organizations, insurance companies, and service providers all over the nation. Moreover, to pay your bills, you simply need to do a registration once for each biller. You can set vertical instructions online to consequently pay your common bills on the web. Also, the bank does not charge clients for online bill instalments.

To transfer money

In the current online banking system, a customer can easily transfer funds from their bank to another’s account. E-banking users can also transfer money to some other countries. Moreover, all a user needs to do is mention the account number of a payee with his branch name. The time for money to transfer from one account to another generally depends on the type of transfer (instant or later). Furthermore, customers who are using credit cards can easily manage their cards, pay the bills, or lodge a service request with just on few clicks.

In addition to this, if you are doing your finance degree from countries like the US, it becomes more crucial for you to understand banking and E-banking well. Because living alone in a country can be tough at times when it comes to managing your own finances. Furthermore, your course will also teach you the best budgeting systems. And in case of any academic trouble, you can seek online assignment help in the US.

The Pros and Cons of E-banking

Assuming you are new to e-banking, you would want to save time by using the service. Moreover, millions of people get benefits from E-banking. However, everything comes with pros and cons. So, before adopting anything you should know all about it. Hence, we are going to explain the merits and demerits of E-banking.

Pros of E-banking

- Clients can exchange any amount from one account to the next or another bank’s account. Moreover, they could send money to any place in the world. When you enter your account, you need to refer to the payer’s account number, bank, and branch. The money transfer will occur either at the same time in a day or two. While in a conventional technique, it takes around three business days.

- With an online bank, you can take up to 95 per cent of your business on the internet. Apart from getting to your bank statement and account information, you can easily transfer money, and utility bills, or apply for a card. Moreover, the biggest online banks have simple platform access, so you simply need to associate with your most loved classes. You will be coordinated to the fitting page in a brief timeframe with the fundamental information.

- Web-based banking enables you to save a lot of money. When you use your services of internet banking, most banks ordinarily charge a lower expense. You additionally get the chance to learn more interesting services and products from traditional banks.

- E-banking offers top security to guard their user with the most recent encryption method to stop false activities. For example, identity theft and phishing. However, when it is given, users need to complete their role and also have recent antivirus, antispam, firewall and anti-spyware software installed on their PCs.

- The capacity of online banks to offer higher returns and more services is because of the way that they have less overhead cost.

In addition to this, if you ever come across any finance or business-related academic problems, you can always seek help from an online coursework service.

Cons of E-banking

- E-banking services give various advantages to the user. However, regardless of its favourable circumstances, some users are looking to know its downsides as well. Regardless of the expanding popularity of online banking, it cannot be expected that a few users are as still care about making monetary transactions.

- Numerous individuals are hesitant to utilize E-banking because of security risks. They still believe that online banking can lead to fraud after watching the news that hackers have done online robbers. But the reality is, that banking institution that offers Internet banking used to keep security on top priority. These banking institutions respect their clients. Moreover, they generally utilize the most innovative security to ensure their sites.

- Many people still don’t trust E-banking. For new clients who have just acknowledged money-related transactions for some time. They may even now feel hesitant whether they have made the best decision or not, whether they have tapped on the correct key or not.

- The user who is using E-banking for the first time, directed through the Internet bank site can feel the complexity. Moreover, it might require more time to open an account since certain websites usually request identification like personal identity, and photo proof which can change the mind of a customer.

This was all about the pros and cons of E-banking. Apart from this, if your finance classes and related assignments are giving you a tough time then do not forget to speak up to an expert and seek online assignment help. Similarly, if you find an E-banking complex, then you must learn it from someone good at operating banking through the Internet. Because it will not only save you time but provide other benefits that traditional banking methods might not.

Conclusion

With the growth of wireless communication and internet technologies in the current decade, the nature and structure of financial and banking services have changed a lot. Hence, E-banking is the latest that uses the internet for the delivery of services and products. Moreover, we learnt that now banking is just not restricted to going to a branch for all the banking activities like cash deposits and withdrawals. Therefore, the concept of e-banking is good, easy, and helpful. It is the cheapest way to provide banking services.

Frequently Asked Questions

| Question: What are the different types of E-banking? Answer: Various types of banking activities fall under E-banking such as mobile and internet banking, credit and debit cards, ATMs, electronic data interchange, and electronic fund transfer. |

| Question: What is e-banking’s primary goal? Answer: It enables users of a public or private network, such as the internet, to access their accounts, conduct business, and get information on a range of financial products and services. |