Table of Contents

Accounting is an important subject for students pursuing business, finance, or commerce. It helps in understanding how money flows in a business and ensures that financial records are maintained properly. It is also a subject that is getting very popular among students. However, whether you are a student or a professional, knowing accounting terms is very important for you. Many students find accounting difficult because of the complex calculations and numerous terms they must remember.

Understanding accounting abbreviations and acronyms makes learning easier. These short forms help students read financial statements quickly, communicate efficiently in assignments, and prepare for exams without confusion. For example, terms like AP (Accounts Payable), AR (Accounts Receivable), and P&L (Profit & Loss Statement) are frequently used in business reports.

In this blog by All Assignment Help, we will explain the most common accounting terms and their meanings in simple language so that you can understand them easily. This will be helpful for students who want to improve their accounting knowledge and perform better in exams and assignments.

Accounting Fundamentals: What Are Abbreviations and Acronyms?

Before we go ahead and discuss accounting terms, let’s first understand what abbreviations and acronyms are.

Abbreviations- A shortened form of a word, such as AP for Accounts Payable or BS for Balance Sheet.

Acronyms- A type of abbreviation that forms a new word from the first letters of multiple words, such as GAAP (Generally Accepted Accounting Principles) or ROI (Return on Investment).

These short forms save time, improve communication, and make accounting easier to understand. Instead of saying “Generally Accepted Accounting Principles”, people simply say GAAP. These shortened forms help accountants, finance professionals, and students communicate clearly without repeating long phrases. Students need to learn these abbreviations, especially when they have to prepare reports, solve financial problems, or study for exams.

Why Are Abbreviations and Acronyms Important in Accounting?

There are several reasons why abbreviations and acronyms are essential in accounting. They are a key part of accounting fundamentals. While the subject is growing in popularity, it remains complex. Hence, students tend to struggle with it a lot. With so much to focus on, having a stronghold of these short forms makes their learning process smoother. These abbreviations help students save time while reading financial statements, understanding reports, and solving problems quickly.

However, despite these shortcuts, many students still find accounting challenging, especially when balancing coursework with other responsibilities. The pressure of handling multiple assignments and exams at once leads them to seek external support. Some even end up seeking accounting assignment help when overloaded with deadlines.

Understanding accounting terminology is important for academic success, and knowing these abbreviations makes the learning journey much easier.

Here are a few reasons why they are important:

- Financial reports are filled with abbreviations. Knowing them saves time.

- Accounting professionals use these terms in reports, emails, and financial statements.

- Instead of memorizing long definitions, students can quickly recall abbreviations while studying.

- Knowing these terms helps students solve assignments faster and score well on exams.

Common Accounting Terms & Their Definitions

Whether you are pursuing your accounting course online or offline, you will need to manage multiple subjects, assignments, and exams, making academics more stressful than ever. Among all the challenging subjects, accounting stands out due to its technical nature, complex calculations, and various financial terms.

From preparing balance sheets and understanding cash flow to dealing with tax concepts, accounting can quickly become overwhelming. This is why many students prefer to connect with online class helpers to ease their academic burden and receive expert guidance.

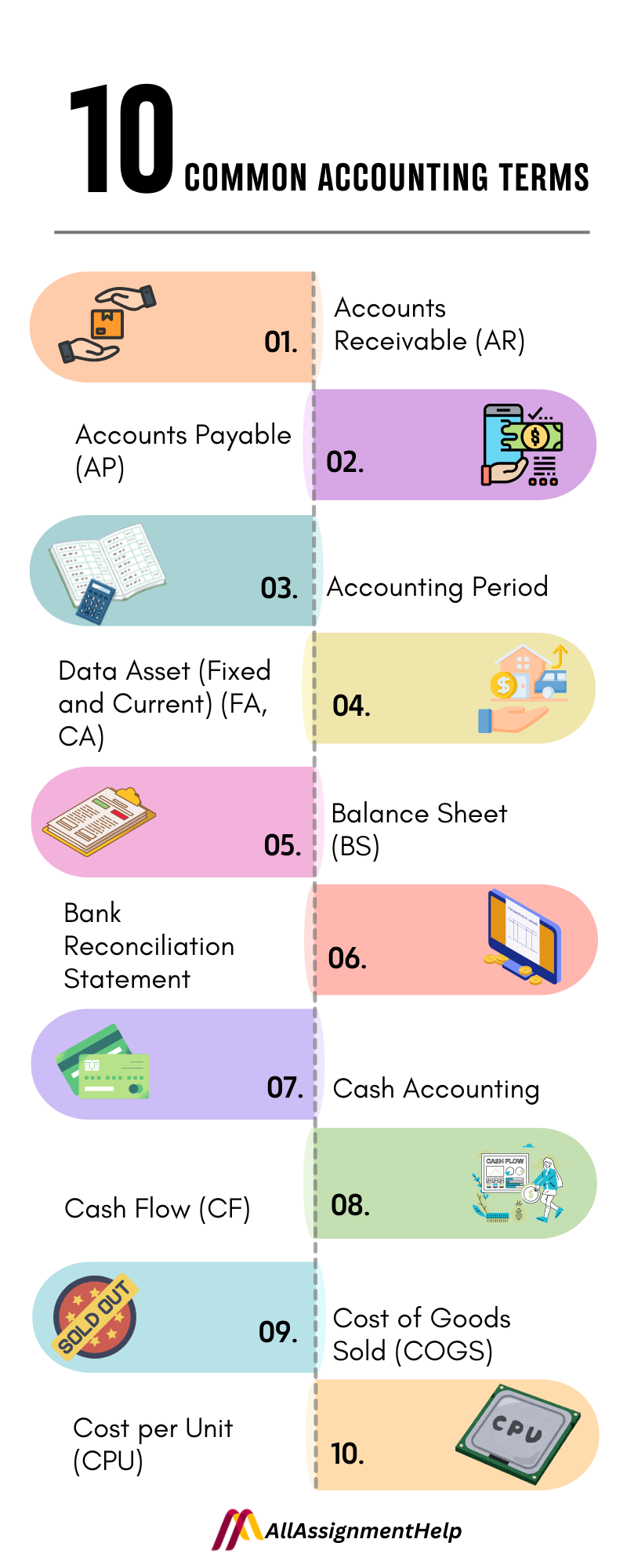

Here’s a list of common accounting terms:

Accounts Receivable (AR)

Accounts receivable are a key part of accounting fundamentals. It refers to the money a company has yet to receive from customers for delivered goods or services. Simply put, it is the amount customers owe a business.

Accounts Payable (AP)

Accounts payable is the opposite of accounts receivable. It refers to the money a business owes to suppliers or vendors for goods or services received but not yet paid for.

Accounting Period

An accounting period is a specific time frame for which financial statements are prepared. It can be monthly, quarterly, or yearly, depending on the company’s needs. Businesses use accounting periods to track financial performance and ensure accurate reporting. This allows them to analyze profits, losses, and overall financial health efficiently.

Accrual Accounting

Accrual accounting is a method where businesses record revenues and expenses when they are earned or incurred, rather than when cash is received or paid.

Asset (Fixed and Current) (FA, CA)

Assets are everything a company owns that has value. Fixed assets (FA) include long-term items like buildings, machinery, and land, which are not meant for immediate sale. Current assets (CA), on the other hand, include cash, inventory, and accounts receivable, which can be converted into cash within a year. Assets are essential for a company’s growth and financial stability.

Balance Sheet (BS)

A balance sheet is a financial statement that shows a company’s assets, liabilities, and equity at a specific point in time. It helps businesses understand their financial health by showing what they own (assets) versus what they owe (liabilities). The balance sheet follows the equation:

Assets = Liabilities + Equity

Bank Reconciliation Statement

A bank reconciliation statement is a document that helps match a company’s records with the bank statement. Sometimes, differences arise due to outstanding checks, bank fees, or errors.

Capital (CAP)

Capital refers to the financial resources or funds a business uses to operate and grow. It includes money invested by owners, retained earnings, and funds raised from investors. Without sufficient capital, a company may struggle to expand or cover operational costs.

Cash Accounting

It is a simple method where transactions are recorded only when cash is received or paid.

Cash Flow (CF)

It represents the movement of money in and out of a business. A positive cash flow means a company has more money coming in than going out, while a negative cash flow indicates more expenses than income.

Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) refers to the direct expenses involved in producing goods or services. It includes raw materials, labor, and manufacturing costs. COGS is essential for determining a company’s gross profit and pricing strategy.

Cost per Unit (CPU)

The cost per unit is the total cost of producing one unit of a product. It includes manufacturing costs, raw materials, and labor.

Credit (CR)

Credit in accounting refers to an entry that increases liabilities or revenue and decreases assets or expenses. It is recorded on the right side of a ledger account.

Debit (DR)

Debit is the opposite of credit. It increases assets or expenses and decreases liabilities or revenue. Debit entries are recorded on the left side of a ledger.

Depreciation

Depreciation is the gradual reduction in the value of fixed assets over time due to wear and tear or obsolescence.

Equity (E)

Equity represents the owner’s stake in a company after liabilities are deducted from assets. It includes investments, retained earnings, and stockholder shares. A high equity value indicates a financially strong business.

Generally Accepted Accounting Principles (GAAP)

GAAP is a set of accounting standards used to ensure financial statements are prepared consistently and accurately. Companies follow GAAP guidelines to maintain transparency and credibility in financial reporting.

General Ledger (GL)

A general ledger is a complete record of a company’s financial transactions. It contains all accounts, including assets, liabilities, income, and expenses, helping businesses track their financial health.

Gross Profit (GP)

Gross profit is the amount a company earns after subtracting the cost of goods sold (COGS) from total revenue. It helps businesses understand profitability before deducting operating expenses.

Inventory

Inventory refers to raw materials, work-in-progress items, and finished goods a company holds for sale. Proper inventory management is essential to avoid overstocking or shortages.

Journal Entry (JE)

A journal entry is a record of a financial transaction in a company’s accounting books. Each entry includes a debit and credit, ensuring accurate bookkeeping.

Liability (Current and Long-Term) (CL, LTL)

Liabilities are the debts a company owes. Current liabilities (CL) are due within a year, such as short-term loans or accounts payable. Long-term liabilities (LTL) extend beyond a year, like mortgages or bonds.

Limited Liability Company (LLC)

An LLC is a business structure where owners are not personally responsible for the company’s debts. It provides flexibility and tax benefits while limiting personal financial risk.

Net Income (NI)

Net income is the company’s total earnings after deducting all expenses, taxes, and costs from revenue. It indicates a business’s profitability.

Profit and Loss Statement (P&L)

A profit and loss statement summarizes a company’s revenues, costs, and expenses over a specific period. It helps businesses assess profitability and make financial decisions.

Revenue (Sales) (Rev)

Revenue is the total income a company earns from selling goods or services. It is the starting point for calculating profit.

Return on Investment (ROI)

ROI measures the profitability of an investment by comparing the gain or loss against the initial investment cost. A higher ROI indicates a successful investment.

Accounting fundamentals are essential to understand. And pursuing a career in this field provides structured, in-depth learning. Many students opt for online courses to enhance their logical thinking and knowledge.

Balancing online and offline classes may seem challenging, but technology offers effective solutions. Simply connecting with online class help services and requesting, please take my online class for me, provides the support needed to manage both efficiently.

Overcoming Online Accounting Course Stress: Strategies That Work

Accounting is a detailed and technical subject, requiring strong analytical and problem-solving skills. Many students feel stressed about balancing coursework, exams, and assignments. This is where expert guidance becomes helpful to know everything about accounting fundamentals.

Here are some effective strategies to overcome your accounting course stress.

- Stay Organized: Keep track of deadlines, assignments, and exams with a planner or digital calendar.

- Break Down Topics: Study in small chunks instead of cramming everything at once.

- Use Online Resources: Watch video tutorials, join study forums, and use accounting apps to reinforce concepts.

- Ask for Help: Reach out to instructors, tutors, or classmates when you need clarification.

- Practice Regularly: Work on problems consistently to strengthen your understanding and accuracy.

- Manage Your Time: Set a study schedule that includes breaks to avoid burnout.

- Stay Positive: Keep a growth mindset and remind yourself that improvement takes time.

By following these strategies, you can reduce stress and succeed in your online accounting course. If exam anxiety makes it hard to focus, managing stress is key. Many students struggle to balance coursework and exams and wonder, can someone take my online exam for me? Instead of feeling overwhelmed, build strong study habits, seek help, and use available resources to stay on track.

Last Thoughts!

Learning accounting fundamentals is essential for students pursuing finance, business, or accounting careers. These terms help in understanding financial statements, making business decisions, and improving financial literacy. If you’re struggling with accounting assignments, exams, or coursework, getting expert help can make a huge difference.

Many students struggle to balance subjects like accounting, math, science, and economics. Math can be especially tough due to its complicated nature, making some wonder, can someone do my math class for me? This is a common challenge. However, by seeking expert support from reliable online assignment help sites, they can ease stress and improve performance in offline as well as online classes.

FAQs

1. Why is it important to learn accounting fundamentals?

They help students quickly understand financial statements, improve communication, and simplify complex concepts.

2. What are some common accounting fundamentals that students should know?

Key abbreviations include AP (Accounts Payable), AR (Accounts Receivable), BS (Balance Sheet), and P&L (Profit & Loss Statement).

3. How can mastering accounting terminology help students perform better in exams?

It enables quick recall, reduces confusion, and helps solve financial problems efficiently during exams.

4. What should I do if I find accounting assignments and exams difficult?

Seek expert guidance, use online resources, or get professional help to manage coursework and improve grades.