Table of Contents

Accounting is one of the fastest-growing careers in the present day. It has been observed that 7 out of 10 students choose accounting as their career path. There is a common assumption that accounting and commerce are much easier than science. But in reality, the story is totally different. Both are completely different fields and unique in their own way. Many students, for instance, have a difficult time dealing with issues associated with accounting methods – and the Cost Method is the primary one. When pursuing a degree in accounting, students are expected to know the topic cost method in and out and if not, it may hinder them in completing the degree and most importantly, may hinder them in getting a good job at the end of their studies.

This blog labeled as the average cost method a detailed explanation ideated and written by the experts’ team at Allassignmenthelp will try to help individuals having a tough time with the cost method by providing a detailed explanation of this process and associated lingos.

The Average Cost Method’s Definition and Goals

The average cost method in accounting is a method for calculating the cost of inventory. To calculate the average cost of inventory, the total cost of inventory and the number of items or units present in the total inventory are considered. Moreover, the average cost method is a process of assigning relevant costs to each item in inventory at the time of selling such inventory item.

Many business organizations choose to apply the average method rather than using other inventory valuation methods such as LIFO (last-in-fast-out) or FIFO (first-in-first-out). It’s all because the average cost method is used to minimize the drastic and sometimes negative effects of allocating costs on the inventory items based on the item’s value on the date of purchase.

Read more: Master the Art of Different Writing Styles

Core Idea Behind the Development of the Cost Accounting System

The rapid growth of the Industrial Revolution has instigated the need for developing cost accounting in businesses. Prior industrial development, most business organizations were run in a small and medium basis.

As businesses have grown and developed vastly and this increased the complexities of within their operations, the need for tracking costs turned out to be crucial for successful and hassle-free business operations. Therefore, these complexities in the business environment instigated the need for effective management. This accordingly became the main reason behind the rise of the cost accounting system.

Are you into accounting and facing issues with the average cost method and other associated assignments? Instead of getting panicked, hire a cost benefit accounting assignment help service to assist you. Experienced professionals can take great care of your cost benefit paper and help you achieve sky-high marks.

Also Read: Cost Benefit Analysis: Your Path towards Success

The Core Idea of The Average Cost Method and Its Work

To be able to run successfully and stay afloat in the current high-competitive market, large and mid-sized organizations need continuous improvement within the management systems and business activities. This activity has provoked the evolution of the cost accounting system.

Cost accounting is a branch of accounting that solely involves collecting, analyzing, recording, summarising, interpreting, and reporting financial data and information of an organization.

Let’s get to know more about it in a brief:

- The average cost method is calculated by dividing the total cost of items (goods) in inventory by the total unit of goods, present in the total inventory, available to the company for conducting sales activities.

- This method is also known as the weighted average method.

- Under this method, the cost of inventory is assumed based on the average cost of goods available in a company’s hand for sale during a particular period.

- Over the passing time, several segments are added to this accounting system. One of them is the average cost method. It refers to a method of inventory costing.

- The cost of each item in a company’s inventory is calculated using this method.

Students often have a tough time managing their academic cost accounting papers. This is when they get confused and if not handled strategically, their marks may reduce significantly as such assignments are assigned often to students throughout their academic course to assess their abilities and skills. If you think you are also facing trouble managing your cost accounting papers, without any further delay, hire a cost accounting assignment help service to balance your studies. They are available round the clock to provide you with top-notch help with assignments so that you can focus on your studies.

Also Read: Cost accounting: Detailed explanation

Why is the Average Cost Method the Right Choice for Organizations?

The application of the average cost method necessitates slight labor and is considered the least costly method of inventory valuation.

Let’s find out the key reasons for considering the Average Cost Method the apt one:

Simplest method

It is the simplest method of inventory valuation and is very trustworthy.

It cannot be manipulated ever

The company’s income cannot be manipulated as it often uses the average cost method to evaluate its inventory value. On the other hand, when using other inventory costing methods, there are consequently some grounds to manipulate income figures easily by calculating inventory costs in a manipulated way.

To stand out with similar products and/or services from compatitors

A company that sells similar products or services that are difficult to differentiate from each other often find it tough to compute the cost attached per unit of such product. To overcome this problem the company prefers to apply the average cost method.

Helps in better tracking

This method helps a company track every single product when it operates by moving huge volumes of almost identical products through inventory.

Helps in striking to the same process of accounting

Consistently following the same during the accounting periods companies adopting to this particular inventory costing method must stick to it for the upcoming accounting periods.

Can switch to investor costing method with it easily

A company is free to change its inventory costing method from the average cost method to any other cost method.

Easy for company to reflect its changes using this process

A company must reflect such change through its financial statements for its investors and other stakeholders.

For the above-mentioned reasons, the use of average cost method gained popularity among companies across the globe. Now, companies require individuals who are great at average cost method and if you are among those pursuing a degree in accounting can think of a job that entails working with such process at a high salary. However, getting such a job is only possible when you have a good academic result in this subject. Students who are great at applying average cost method often fail to do well in their exams and lose such opportunities. If you are among them facing difficulties managing your exams online, instead getting tensed, hire online exam help service just by typing Take my online exam for me on Google. This way, you will find genuine services having experts to appear in your exams and help you attain high grades and excel in your professional career eventually.

Similarly, you can hire an online class help service as well if you think you are not able to manage your online classes due to assignment pressure. Instead of wondering I wish I can pay someone to do my online class for me, you can actually get one in your region who can help you balance your studies well.

Average Cost Method Calculation Process

As the name says, the average cost method, it uses to price items lying in a company’s inventory. For instance, it considers the average cost of every similar product or item available in the company’s hand for sale. However, the process of calculating the weighted average cost of inventory is helped with an example provided below.

The below-provided example shows the average cost method of valuing inventory:

Let’s assume that the company has conducted the following transactions in its first month of business operations.

| Date | Purchases (Units) | Rate (per unit) | Sold/Issued (Units) | Balance (Units) |

| 01-05-2021 | 2,000 | @ $4.00 | 2,000 | |

| 15-05-2021 | 6,000 | @ $4.40 | 8,000 | |

| 19-05-2021 | 4,000 | 4,000 | ||

| 30-05-2021 | 2,000 | @ $4.75 | 6,000 |

Further, to help you understand, the above data was derived from a fictitious company. The weighted average cost method is calculated using the inventory method, COGS (cost of goods sold), and ending inventory.

| Invoice Date | No. of Units | Cost per Unit |

| 01-05-2021 | 2,000 | $4.00 |

| 15-05-2021 | 6,000 | $4.40 |

| 30-05-2021 | 2,000 | $4.75 |

| Total Inventory | 10,000 | |

| Weighted Average Cost of inventory (per unit) = $43,900/10,000 = $4.39 | ||

| Inventory in units (Closing Inventory) = (10,000 – 4,000) * $4.39 = $26,340 | ||

| Cost of goods available for sale | $43,900 | |

| Less: Closing inventory | 26,340 | |

| Cost of goods sold | $17,560 |

If the company has opening inventory, it is included in the total available units for sale as well as the total cost of goods available for sale when calculating the per unit average cost of inventory. If you face difficulties in dealing with your accounting papers problems, then you can pay someone to do your homework at any time and from anywhere.

The Different Types of Average Cost Methods That Are Used Often

The average cost method is divided into two types.

Let’s take a further look into these:

Weighted average cost method

In accounting terms, the weighted average cost method, therefore, is an inventory method that identifies the average weight of the cost of goods sold and inventory.

The inventory cost at the end is calculated with this method. As a result, it’s computed by dividing the cost of goods for sale by the number of units available for purchase.

Moving the weighted average cost method

A moving average cost, therefore, is a method is an inventory method that calculates the average unit cost of all the units.

This method is difficult to use, but it provides you with an accurate price and value for your company. It can be calculated by dividing the overall cost of purchase by the total cost of sales of goods.

To be able to handle real time tasks related to both these average cost method types, one must know these. If you think, you are not able to handle any one or both type of papers while pursuing a course in accounting, a professional accounting assignment help service can sort your issues quickly! Their experts have vast knowledge in doing such assignments and by paying a small amount, you can have peace of mind and focus on sharpening your skills in learning these processes better.

Advantages and Disadvantages of Average Cost Method

Consequently, the average cost method is one of the most widely used methods for determining the value attached to the cost of goods sold and assigning costs to each item in inventory. Therefore, this method is used in both perpetual inventory and periodic inventory systems.

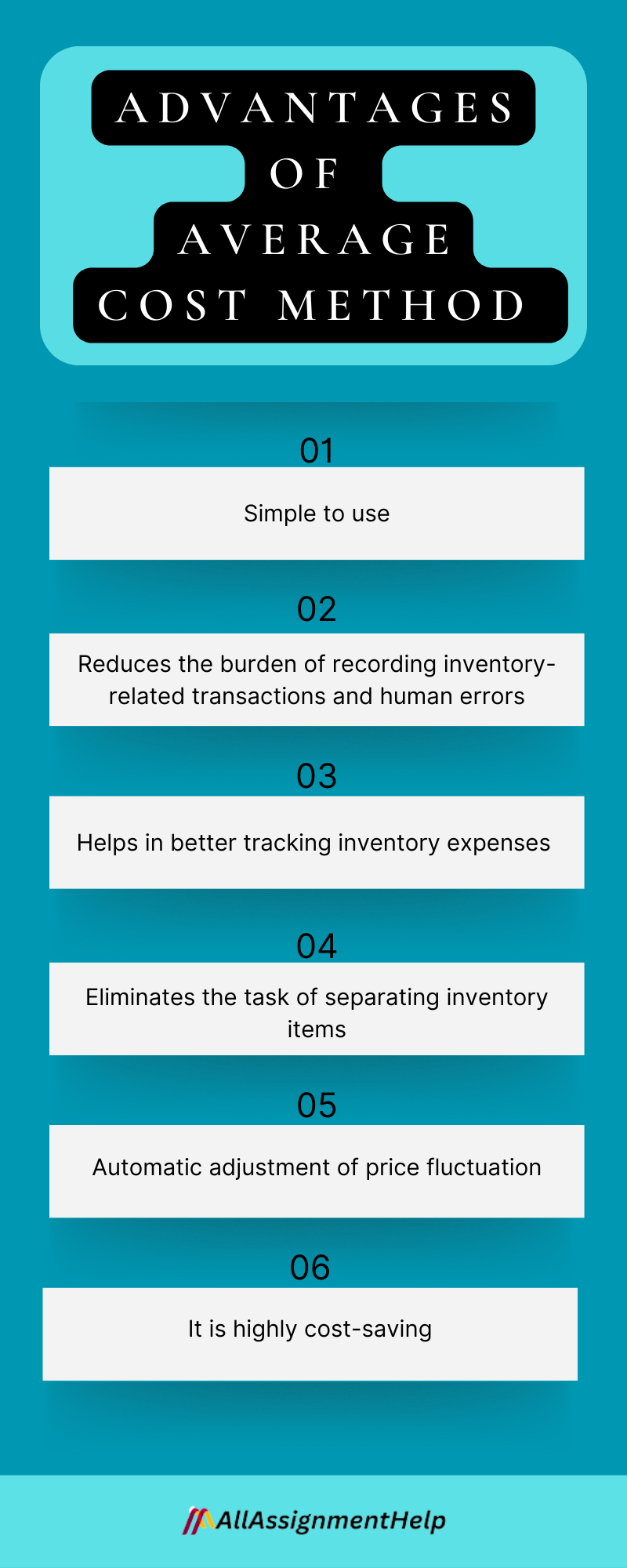

Furthermore, there are several advantages of applying the average cost method for calculating inventory and these advantages make this method one of the most popular methods of inventory valuation among the other methods. We need to take a close look at the both advantages and disadvantages of average cost method to better understand the process.

The following are the benefits of using the average cost method:

Simplicity

The biggest benefit of using the average cost method instead of other methods like LIFO and FIFO is its simplicity which helps the users to calculate inventory value in a very simple and easy manner. This method also simplifies the process of record-keeping as well as simplifies the processing of inventory ordering even if the company operates with a high frequency of inventory ordering.

Reduces the burden of recording inventory-related transactions and human errors

Bookkeepers do not keep the track of every single batch of inventory bought in along with its respective purchase price and it creates the chances of errors. However, this method helps to reduce the burden of recording inventory-related transactions and human errors.

Helps in better tracking inventory expenses

Furthermore, the average cost method is the simplest process of tracking inventory expenses. While retrieving the units, the company does not need to track the original cost of inventory before pricing it to make it available for sale. It helps users, however, to mark up the average price of units and this makes picking and pricing inventory easy.

Eliminates the task of separating inventory items

The average cost method is considered a better inventory valuation method than LIFO and FIFO when applying it to value products that are not easy to separate or impossible to distinguish from others. For instance, iron ore, wheat, oil, etc. always purchased in batches are some products that are not possible to separate one batch from another. Hence, the average cost method treats each batched of inventory without separating them by considering different batches purchased at different times. This method is thus much more relevant and suitable for companies to operate by using these kinds of inventories.

Automatic adjustment of price fluctuation

This method is thus used to adjust the effects of price fluctuation automatically. For example, assume a company has closing inventory from the last batch purchased when prices increased unexpectedly. However, this method normalizes the price by the fluctuation in it. Because it spreads the price hike effect and thus normalizes the sudden fluctuations. In this case, the average cost method manages it much better than other methods.

Cost-saving

Moreover, among the three methods of inventory valuation, the average cost method is the most cost-effective. However, it requires less cost and time to calculate inventory value than other methods. Sometimes, because labour cost stands as a vital expense in every company, reducing the time spent on valuing inventory is cost-effective for the company as well as frees up the employees of the company to focus on other tasks.

It can be simple to understand things theoretically for students, but putting them into practice can be difficult. Having trouble dealing with your cost accounting problems, you can seek help just by typing do my assignment on your search engine to get professionals work for you.

Disadvantages of average cost method:

Apt only for indistinguishable services and/or products

Unfortunately, you cannot use average cost for inventory in industries where the products are not identical.

May affect reporting

If the cost of a stocked item fluctuates, it can lead to errors in reported sales profit. This may lead to issues down the management line

Be it assignments, online classes or even online exams, you can seek any type of assistance from experts. With deep knowledge in handling LMS systems like Blackboard and Canvas (used by institutes to offer online courses to students) and premium IP address masking tools, students can get help without letting anyone know that they are taking external help for their betterment.

Also Read: What is the major objective of managerial accounting?

Job Opportunities for Individuals Having Expertise in Average Cost Method

There are various opportunities and job roles available for students having Expertise in Average Cost Method. As more companies are cropping up, the options to get a job in this segment is also very high.

Tae a quick look at the job roles below:

Financial controller

- Chief financial officer

- Vice-president of finance

- Cost accounting manager

- Senior cost accountant

- Staff cost accountant

- Junior accountant

- Accounting assistant

- Accounting clerk

If you are able to complete the course successfully, you have many doors open to start your professional career in cost method.

Get All Sorts of Assistance in Average Cost Method from Experts

All Assignment Help, is among the leading assignment helper online, online class as well as exam help service provider that help students excel in their overall academics. With years of experience, we have proven ourselves to be the best in this industry.

Take a look at our USPs below to know why we are the best when it’s about Average Cost Method assignment, class or exam:

- We provide assistance in all the locations like USA, UK, Canada, Singapore, or in any part of the world

- Our experts have years of experience in handling real-time scenarios related to average cost method process

- We have native experts holding degrees like Masters and PhD to address your issues

- Our service is available 365 days a year

- Assignment solutions provided with 0 plagiarism and on-demand plagiarism report

- Great discounts and attractive referral concessions

We can help you with your assignments and can assist you in scoring good grades.

Frequently Asked Questions

| Question 1: What is the formula for calculating the average cost method? Answer: The average-cost technique, also known as the weighted average cost method, is a method of calculating inventory value in accounting. To arrive at this value, the total cost of products is divided by the total quantity of items throughout a specific accounting cycle. |

| Question 2: What is the average cost of supplies? Answer: The cost of supply (CoS) helps to find the cost imposition of various customer categories. The cost to a utility of delivering one unit of electricity to a customer’s metering point is called the cost of supply in terms of electricity. It also gives detailed cost information for functionality that has been functionalized, classified, and assigned to diverse customer groups. |

| Question 3: What is the difference between average and marginal cost? Answer: The marginal cost is the difference between the total cost of adding a new product and the total cost of not adding it. The total output is divided by the total cost to arrive at an average cost. |

| Question 4: What are the different steps of an accounting cycle? Answer: The accounting cycle consists of eight steps. They are transactions analysis; entering all the transactions in the journal; posting them into the ledger; unadjusted trial balance; adjusting the entries of trial balance; preparing the financial statements, and the closing of all the books and accounts. |