Table of Contents

Students should be aware of their dependent status when filling out the Free Application for Federal Student Aid (FAFSA) form. FAFSA is the initial step for getting financial help. However, the form you complete will vary based on whether you are an independent or dependent student. This is because your dependency status dictates whether you will include information from your parents or just from you. To put it another way, you will complete a FAFSA form to find out how you can pay for college and whether you are eligible for certain work-study programs, grants, and subsidized or unsubsidized loans. Now, let’s understand which category you are falling into. Read this blog on the student classification guide created by All Assignment Help to determine whether you meet the criteria for an independent or dependent student.

Key Questions to Determine Independent or Dependent Student Status

The Federal Student Aid office, a division of the U.S. Department of Education, poses important questions that enable students to determine their official status. They will be classified as either an independent or dependent student based partially on their responses to the questions on the FAFSA form. Each year, the Federal Student Aid office publishes the questions, which can vary slightly.

Among the questions being asked are the following:

- Are you married as of right now?

- Have you served in the United States military before?

- Did either of your parents pass away before the age of 13, were you placed in child welfare, or were you a court ward or dependent?

These questions might assist students in figuring out if they meet FAFSA dependent student guidelines or FAFSA independent student requirements. However, a student is regarded as an independent student if they select “yes” for any of the FAFSA’s questions.

Read Here: Top Scholarships for Low-Income Students – A Pathway to Higher Education

Independent or Dependent Student: Key Differences

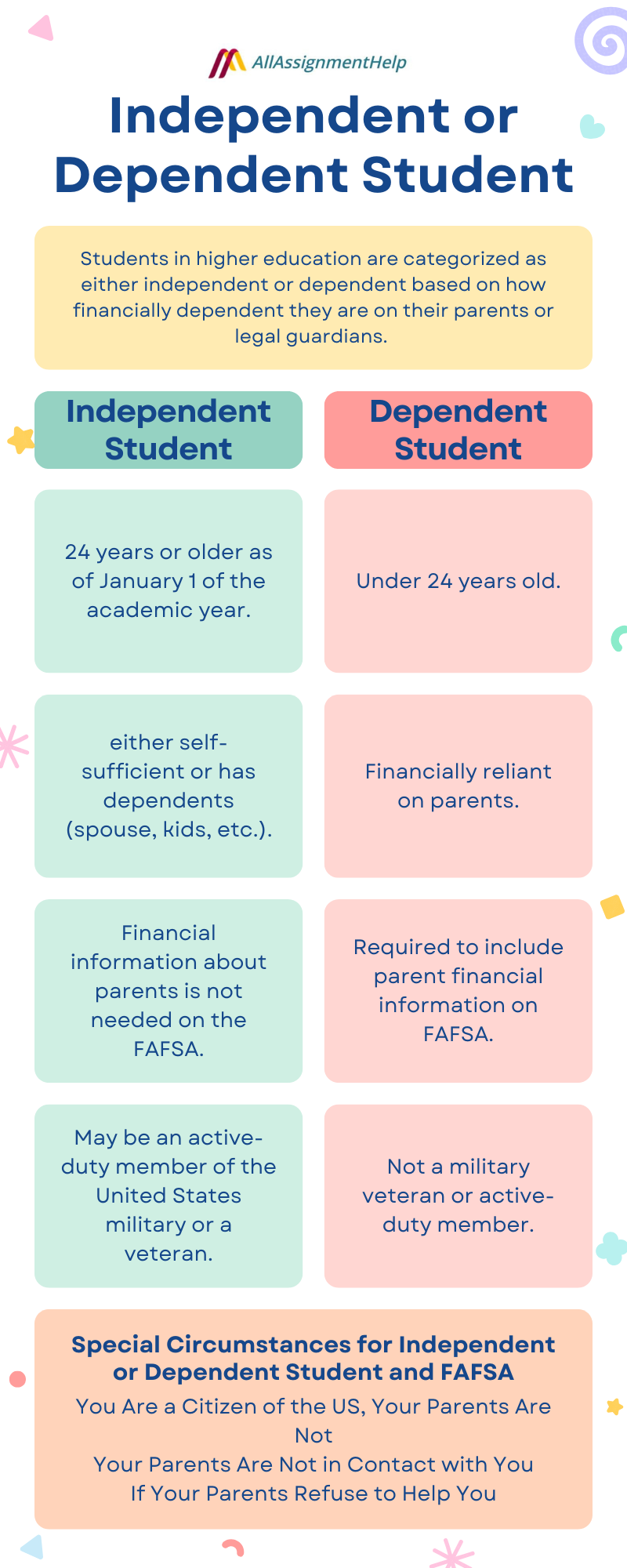

Students in higher education are categorized as either independent or dependent based on how financially dependent they are on their parents or legal guardians. The following table lists the main distinctions between Independent or dependent student, particularly in financial help in countries like the US:

| Criteria | Independent Student | Dependent Student |

| Age | 24 years or older as of January 1 of the academic year. | Under 24 years old. |

| Martial Status | Can be married. | single (unmarried). |

| Financial Support | either self-sufficient or has dependents (spouse, kids, etc.). | Financially reliant on parents. |

| Parent Information | Financial information about parents is not needed on the FAFSA. | Required to include parent financial information on FAFSA. |

| Military Status | may be an active-duty member of the United States military or a veteran. | Not a military veteran or active-duty member. |

| Foster Care or Orphan | can be an orphan or court ward, or they may have been in foster care. | Foster Care or orphans |

| Graduate Program Enrollment | automatically regarded as independent if enrolled in graduate or doctoral programs | Usually applies to undergraduate students. |

| Dependency Overrides | Can apply for a dependency override if there are exceptional circumstances. | usually regarded as dependent until they fulfill certain requirements. |

While financial help for higher education can ease some burdens, students still face the pressure of performing well academically. They often have to complete multiple assignments and writing tasks. Fortunately, there are many online assignment help services available to assist students in meeting deadlines while maintaining their academic performance.

Financial Help Options for FAFSA Independent Student

Below listed the important independent student qualifications to get financial help for their higher education:

Subsidized Federal Loans

For independent students, both the conditions and borrowing restrictions of federally subsidized loans are the same. However, when you apply as an independent, you can be eligible for a larger amount of subsidized loans, depending on your income. You are not eligible for subsidized federal loans if you are pursuing a graduate degree.

Unsubsidized Federal Loans

Unsubsidized federal loans are accessible to independent students who do not have to prove they are in need of money. For independent students, the unsubsidized loan restrictions are different. Up to $35,000 can be borrowed by undergraduates, and up to $73,000 can be borrowed by graduate or professional students (including all loans taken out during undergraduate studies).

Education Credits

Students can earn education tax credits if they file their taxes independently of their parents. One can reduce tuition costs by taking advantage of the American Opportunity Credit, the Lifetime Learning Credit, and the Tuition and Fees Deduction. However, you can receive more money on your return if you apply for these credits and deductions when you file your taxes.

Scholarships

Independent students of all academic levels can also benefit from scholarships. Independent students can become eligible for additional scholarships depending on their income. You can improve your chances of receiving a scholarship by applying as an independent applicant. Also, it makes it simpler to prove financial need.

Grants

Independent students have an easier time applying for income-based awards than dependent students. Applying for financial aid as an independent will increase your eligibility for grants like the Pell Grant if your income is lower than your parents’.

Private Loans

Private loans are another option for independent students. However, this kind of financial assistance should only be used as a last resort. It could be challenging for you to get a private loan if you don’t have a lot of credit or other financial history. The majority of lenders restrict their lending to candidates with good credit histories to reduce risk.

In general, being independent makes you eligible for more financial aid options. College students usually earn less money than their parents. Once you have independent status, you can take their salary out of your financial aid calculation. Moreover, independent students who earn on their own will also be eligible to pay for online class help services without putting an extra burden on their parents. Yes, you read that right. If you earn money, you can ask online services, can you do my online course and solve all your concerns? The experts of these websites can be lifesavers when you encounter difficulties during your online classes or need additional support to understand your coursework.

Financial Help Options for FAFSA Independent Student

The following outlines the essential dependent student requirements for seeking financial help for their higher education:

Subsidized Federal Loans

The federal government gives dependent students subsidized loans following their financial necessity. However, your borrowing limit is set by your school. The Department of Education covers the interest on subsidized loans for the first six months following graduation while you are still enrolled in school.

Unsubsidized Federal Loans

You do not need to prove financial necessity to receive an unsubsidized federal loan. Interest on unsubsidized loans must be paid both during your time in school and after you graduate. Fortunately, the federal government often gives more credit limits for unsubsidized loans. You usually receive a larger amount of these loans from schools.

Parent PLUS Loans

The federal government provides PLUS loans and doesn’t require proof of financial necessity. On average, they have higher borrowing limitations than both subsidized and unsubsidized loans. However, PLUS loans could necessitate a credit check. They can pay for tuition less any further financial aid you could get.

Scholarships

Scholarships are provided by multiple institutions, including private businesses, government entities, and nonprofits. These rewards are quite competitive. They often require applicants to exhibit professional aptitude, community service, or academic excellence. Dependent students who get scholarships can save a comparable amount of money which they can spend on getting math assignment help, chemistry assignment help, or any subject they need assignment help with.

Grants

Scholarships and grants work similarly. However, the majority of grants have fewer stringent application requirements than scholarships. For example, all you have to do to be eligible for the Pell Grant is prove that you have severe financial need. Other grants might benefit particular student groups, like teachers or veterans.

Dependent students are identified as dependents on the tax returns of their parents. They have to provide their parents’ financial data in addition to their own when filling out the FAFSA.

How Is the FAFSA Affected by Your Dependency Status?

Whether you are an independent or dependent student, your dependency status will still affect your FAFSA eligibility. Based on the student’s dependent status, the Federal Student Aid Office calculates their SAI. Following that, schools utilize your SAI to generate a financial aid package tailored to your needs.

Your yearly and total federal student loan restrictions are usually lower for a dependent student than for an independent student. However, your parents could be eligible to apply for a Parent PLUS Loan to assist with your educational expenses.

However, you will qualify for the higher federal student loan limitations available to independent students if your parents are denied a Parent PLUS loan due to a bad credit history.

It is necessary to understand that your FAFSA dependency status is not based on your tax dependency. You have to fulfill certain requirements to be considered an FAFSA independent student. On the other hand, there is no certain requirement needed if you need someone to do my assignment for me in case you need extra writing assistance or want to complete your work on time.

Special Circumstances for Independent or Dependent Student and FAFSA

Not every student fits neatly into one of the two categories—independent or dependent student. Still, in certain situations, you might not be able to provide your parent’s information on the FAFSA. The following are some common circumstances and what to do in each:

You Are a Citizen of the US, Your Parents Are Not

You are eligible to apply for financial help through FAFSA for your educational costs irrespective of your parents’ citizenship, geographic location, or place of residence in the United States. Additionally, if your parents do not have a Social Security number, it is quite acceptable; you can simply enter zeros in those particular spaces when asked.

Your Parents Are Not in Contact with You

You must still submit your parents’ information on the FAFSA, irrespective of whether you live with other family members or alone. If you can’t do that, you can state on the FAFSA that you are unable to get your parents’ information due to a special circumstance. Therefore, the student does not need to provide this information to continue with the FAFSA application.

If Your Parents Refuse to Help You

Students can fill out a form to declare financial help if their parents refuse to give their child financial aid, are unable to do so because of specific circumstances, or just do not wish to give financial information to the FAFSA. They will consider the situation and perhaps approve the child for both subsidized and unsubsidized loans, which have limits on loan amounts.

Being classified as an independent or dependent student is more than just a formality when it comes to completing the FAFSA form or looking for grants and scholarships. The good news is that you still have a chance to receive financial assistance even if you are in the dependent category. It is because the people in charge of determining who receives financial assistance don’t only consider whether your parents are providing for you. They are also looking at your living situation, GPA, and several other things.

Also Read: How to Become a Foreign Exchange Student: A Step-by-Step Guide

Conclusion

Understanding your status as an independent or dependent student is important while completing the FAFSA and applying for financial assistance. This status influences not just the data that you have to submit, but also the types of financial aid you might qualify for, including grants, loans, and scholarships. This student classification guide will help you know which category you fall under.

However, if you need any assistance with your academic assignments, you can reach out to us at any time of the day. We can help you with assignments, homework writing, and other writing tasks asked by your professor. Along with this, we will also take your online exam as soon as you reach out to us with your query like, can you take my online exam for me? We have experts in all areas to provide complete academic assistance to students in one place.

FAQs

| Do independent students receive more advantages through FAFSA? FAFSA eligibility for independent students is calculated by their own income rather than their parents. This often results in them receiving more financial help. They can qualify for higher loan limits and larger Pell Grants. Also, independent students do not have to report parental financial information, which can increase aid eligibility. |

| What financial documents do independent and dependent students need for FAFSA? Independent students only need their financial information, while dependent students must provide both their and their parents’ financial information. |

| Can I change my dependency status on FAFSA? You cannot change your dependency status unless you meet the specific criteria for independence (e.g., age, military service, marriage) or can prove special circumstances to your school’s financial aid office. |